Chapter 8 – Social Justice, Well-Being and Economic Organization

Coordinating Lead Authors:[1] Gianluca Grimalda, Kalle Moene

Lead Authors:[2] Hiroshi Ono, Fernando Filgueira, John Roemer, Reema Nanavaty, Katherine Gibson, Carol Graham, David Schkade

Word count: 44,959

Abstract: After having reviewed some of the most widely used empirical indicators of social justice and well-being, we discuss the shift from utilitarianism to egalitarianism in the philosophical debate on distributive justice, the Science and Technology Study and feminist approaches to social justice, and account for recent efforts in empirically mapping subjective well-being. We draw on these approaches to evaluate the efficacy of different economic systems in bringing about social justice and well-being. Among other things we focus on the experience of the Nordic countries in achieving high levels of economic development combined with social equality. We argue that the basic tenets of their model can be used in developing countries. The problem is not economic feasibility, but maybe political feasibility. In particular, we explore how egalitarian wage compression can enhance technological innovation and productivity, and how welfare spending may fit well into a progressive development strategy even in poor countries. We also discuss concrete examples of ownership models alternative to the standard capitalistic model. Our analysis then reviews the linkages between economic development and cultural change, asking whether the “social ethos” that seems to be a key ingredient of successful models can be somehow “implanted” in developing economies. We end our chapter with some thoughts on what appears to be the main challenging issues for social justice in the 21st century and beyond.

Summary

The most widely used empirical indicators of social justice and well-being provide a mixed picture of the world. On average there is social progress at the global level. Global inequality appears to have taken a decreasing trend in the mid-2000s for the first time since the beginning of the 19th century. Yet the gaps between the richest and the poorest countries and the richest and poorest households remain staggering. We wonder whether the general economic scenery may become less favorable to global social progress in the coming years, as the wealth of the top 1% of the population is rising in most countries and the top 5% of population in the world have experienced some of the largest gains.

Principles of fairness must be taken seriously to judge these disparities. We provide an overview of the most recent debate over theories of distributive justice in political philosophy. The general consensus has shifted from a utilitarian view of justice to an egalitarian view, where equality of primary goods, capabilities, resources, or opportunities – depending on which perspective is taken - should be guaranteed. The condition of the most disadvantaged in society, rather than its average member, now occupy center stage. Other approaches advocate the liberation of people oppressed by economic or social relationships in capitalist regimes as the basis for social justice.

Empirically, the measurement of subjective well-being over long time spans has revealed some disconcerting truths. In spite of consumption having increased at least threefold in some rich countries since the 1950s, the increase in average subjective well-being has been virtually absent. Moreover, the disappearance of social safety nets associated with institutional changes in transition economies has considerably deteriorated subjective well-being. These findings point to the dependence of subjective well-being from social and institutional conditions.

We use the principles of justice and well-being to understand the consequences of what we call the real competition. This competition takes place also in non-market areas, including institutions and organizational design as well as in politics and between economic systems. In contrast to the personal incentives, individual solutions and short-sightedness of ideal competition, real competition often rewards complementary gains such as cooperation, trust, and long-term thinking. This is why global competitive forces can induce social equality that revolutionizes the political and economic structure from within.

Comparing a wide range experiences in small and large countries from Russia to South Korea and from Scandinavia to Latin America, we explore system competition varying from socialism vs. capitalism to politics vs. markets, including dictatorships with and without markets; and markets with and without a social ethos and social democratic features.

In reviewing some of the most important mechanisms to enhance social justice and well-being we emphasize that there are several ways to achieve social progress. One can i) take wage determination out of market competition and place it into a system of collective decision making, ii) expand the welfare states at the national level, especially the universal welfare programs, iii) provide a national basic income system that frees workers from the slavery of capitalist relationships, iv) transform the structure of property relations and capitalist relations that reclaims the need for collective forms of property, v) stimulate worker cooperatives where the direct producers in each enterprise make all major decisions and share the revenues, vi) work for a new global order with a supranational state that is able to tax, regulate and redistribute capital and income (which can of course include a basic global income) across national borders.

We recommend that social equality in one form or another can be used as a development strategy. There may be a strong complementarity between markets and social intervention emphasizing equality, participation and of social justice. It is important both to use markets and to tame their forces somewhat by democratic polices and countervailing power.

In particular we explore how wage compression induces modernization, innovation and higher productivity. We show how the development gaps between the most modern and the least modern technology in use is determined by how much labor earnings are compressed across workers. These development gaps vary widely across countries. Many think that the US has the most modern economy and should be used as a benchmark against less modern and less efficient economies in say India and China. We demonstrate, however, how the development gap is much higher in the US than in the egalitarian Nordic countries. Social equality provides a more efficient economy. The development gaps again feed-back to sustain the compressed earnings distribution.

Likewise we demonstrate how a welfare state arrangement can be used to enhance capabilities, empower weak groups with inefficiently low earnings, and help the millions that go hungry even in good years. A welfare state can have strong long run effects for productivity and well-being. It may also give rise to a social multiplier at the individual level and to a social equality multiplier at the society level that magnify initial impulses. We also review reasons why any good development path must have continuous redistribution.

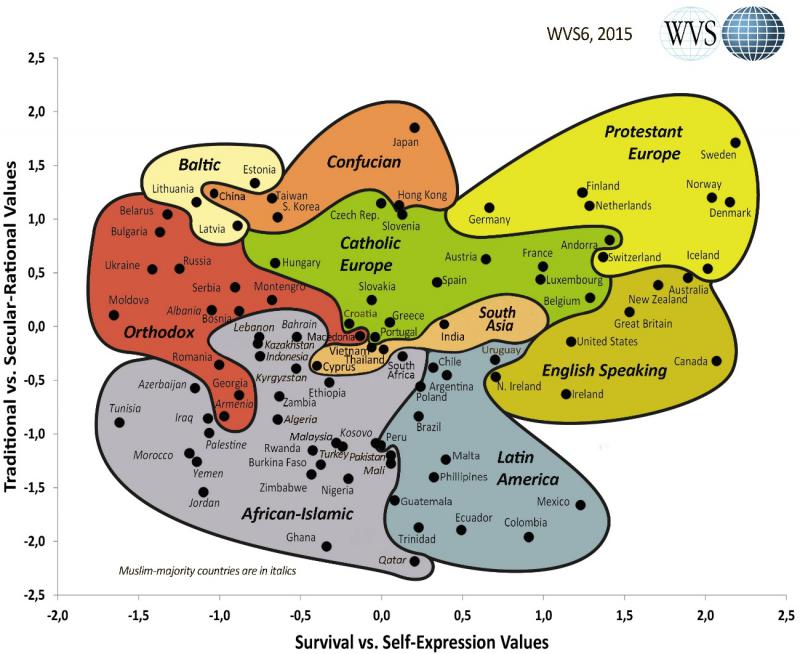

One prominent experience in achieving high levels of economic development combined with social equality stems from the Nordic countries. We argue that the basic tenets of their model can be used in developing countries. The problem is not economic feasibility, but maybe political feasibility. Finally, we warn that it is not easy to implant from above or from outside the “social ethos” that seem to be a key ingredient of successful models. Although economic development, over the long run, seems to go hand-in-hand with rising concerns for the society rather than one’s own material conditions, culture seems to exert long-lasting influences on this path. We end our chapter with some thoughts on what appears to be the main challenging issues for social justice in the 21st century and beyond

1. Introduction

The bourgeoisie, during its rule of scarce one hundred years, has created more massive and more colossal productive forces than have all preceding generations together. Subjection of Nature’s forces to man, machinery, application of chemistry to industry and agriculture, steam-navigation, railways, electric telegraphs, clearing of whole continents for cultivation, canalisation of rivers, whole populations conjured out of the ground – what earlier century had even a presentiment that such productive forces slumbered in the lap of social labour? (Karl Marx and Friedrich Engels, Communist Manifesto)

‘’Can capitalism survive? No. I do not think it can’’ - wrote the conservative economist Joseph Schumpeter in his 1943 book ‘’Capitalism, Socialism, and Democracy’’ (p 61) - and added ‘’Can socialism work? Of Course it can’’ (p 167). While this view must have been shared by many people hundred years ago, it is held by almost nobody today. Instead capitalism is associated with the end of history.

But it should not. Whether alternative systems can work or not may seem irrelevant to most people today. Yet, to explore feasible alternatives may be one of the most important issue in the social sciences today. Even those who believe that global capitalism is particularly ugly, unequal, inhumane and unable to provide lasting benefits to the majority of the world’s population, condemn the system without having a clear picture of what could be the alternative. So the most ardent critics of the social injustice under capitalism are far from most precise in prescribing feasible alternatives.

In the 18th and 19th century, in contrast, critics saw both the progressive sides of capitalism as well as the ugly ones. Some of them defended the system, others attacked it. Common for most of them were their sympathies with the poor segments of society. This is actually an inherent content in modernization theories that originated in the Enlightenment era (Inglehart and Welzel, 2006). They built on the belief that technological progress gives humanity increasing control over nature and that this would be accompanied by cultural change and new value systems (Condorcet, 1795). Modernization theories were also characterized by the idea that such changes are conducive to social and human progress.

Adam Smith, of course, saw many benefits of markets and capitalism. Yet he clearly identified the unequal power, social misuse, and the intolerable inequality of income in the capitalist system. In fact, the entire book, Wealth of Nations, can be read as an attack on the commercial system in England. First of all, Smith was morally concerned ‘’It is but equity, besides’’, he insisted, ‘’that they who feed, cloath and lodge the whole body of the people, should have such a share of the produce of their own labour as to be themeselves tolerably well fed, cloathed and lodged’’ (WN, Book I, Ch. VIII, p. 88). Secondly, inequality to Smith was a form of oppression: ‘’For one very rich man there must be at least five hundred poor, and the affluence of the few supposes the indigence of the many’’ (WN, Book V, Ch. I, p. 232). Thirdly, Smith was skeptical of governmental interferences – not so much for the reasons that are so much used to day, but simply because interventions tended to favor the rich over the poor. He stated, for instance, that we ‘’have no acts of parliament against combining to lower the price of work; but many against combining to raise it’’ (WN, Book I, Ch. VIII, p. 74). So, clear defenders of capitalism, like Adam Smith, were also the most serious critics of the system.

Similarly, the most ardent critics of capitalism, such as Karl Marx, were also heavily impressed by the social progress and the productive improvements that the system offered. Marx was convinced that capitalist dynamics and the political clout of the bourgeoisie led to revolutionary changes in the economy, in politics, and in society at large – as ‘’by the rapid improvement of all instruments of production, by the immensely facilitated means of communication, [capitalism] draws all, even the most barbarian, nations into civilisation.’’ Yet, he insisted, it should be replaced by a distinct alternative - socialism.

Why was he heralding sides of the system, but yet announcing an abrupt end to it? One reason was that the capitalist mode of production was reaching the end of its progressive period, in his view, and that it would be toppled and replaced with a new system of property relations that would foster the further development of technology, labor productivity, and human flourishing. In this revolutionary transformation, capitalist workers, who own no capital, become workers who jointly own the capital stock of the country. The private and highly concentrated ownership of capital characteristic of capitalism would come to fetter technological development, and would be replaced by some kind of social or public ownership of capital. In the end of their manifesto Marx and Engels provide some clues as to what they believed where necessary changes in the relations of production, and how the state and revolution should bring them about.

1. Abolition of property in land and application of all rents of land to public purposes. 2. A heavy progressive or graduated income tax. 3. Abolition of all rights of inheritance. 4. Confiscation of the property of all emigrants and rebels. 5. Centralization of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly. 6. Centralization of the means of communication and transport in the hands of the State. 7. Extension of factories and instruments of production owned by the State; the bringing into cultivation of waste-lands, and the improvement of the soil generally in accordance with a common plan. 8. Equal liability of all to work. Establishment of industrial armies, especially for agriculture. 9. Combination of agriculture with manufacturing industries; gradual abolition of all the distinction between town and country. 10. Free education for all children in public schools. Abolition of children’s factory labor in its present form. Combination of education with industrial production.

Most of these at the time rather radical suggestions have actually been implanted later, many of them during the 20th century, especially in the period after World War II. The delays teach us an important lesson. Reforms that in a period sound radical and even utopian, can easily become politically feasible and even sound like mainstream in later periods. Indeed, agrarian reforms, progressive taxation, inheritance taxes, state property of means of transport and credit, free public education for all children, some national factories, workshops, railroads and shipyards were all implemented. Several of the reforms undertaken in the same fashion were not even considered by the 19th century revolutionaries: public health care, nationally financed pension systems, state monopoly or dominant position in the production of basic utilities (water, communications, electricity).

The countries that perhaps went furthest in implementing egalitarian reforms and institutional changes are located in the north of Europe and in particular in Scandinavia. Surprisingly to some, their model of social democratic development actually owes more to Adam Smith than to Karl Marx. The intellectual inspiration from Smith is not direct, though. But both Smith and the social reformers in Scandinavia fought for the interests of the poor and saw modernization and expansion of markets as the key to escape poverty. Both saw the primary task as removing obstacles to rapid modernization --- Adam Smith pointed at the guild privileges and the monopolies that limited the size of the market, the social democrats pointed at the strong local unions whose wage premiums restricted the expansion of the most productive sectors[3].

What distinguished the social democrats from more conservative followers of Adam Smith like Margaret Thatcher was the solution to the problem of restricting the power of local unions. While Thatcher's solution was to weaken unions as institutions, the social democratic approach was to strengthen unions as institutions and to structure collective bargaining in a highly centralized manner that reduced the influence of high-paid workers in the wage setting process. The oppressing nature of economic inequality, as Smith saw it, was to some extent remedied by empowering weak groups in the labor market and of course by extending the franchise.

As the reforms were implemented well-being went up and a more just social order emerged by gradual changes. The 20th century, especially the 40-odd years after the World War II, saw the rise of the welfare state that empowered people, reduced inequality and transformed society even further. In general, combinations of capitalism and democracy are responsible for most of the 20th century advances in well-being and social justice. No other ‘model’ comes even close to achieving the desired goals to the same degree. And it is not built “on one size fits all” measures, as capitalism is harboring countries as different as the US and Sweden and as Switzerland and Japan.

Now, however, the heterogeneity has been under attack for a while. A renewed capitalist ideology, falsely claimed to take inspiration from Adam Smith, has triumphed. It attacks the most progressive arrangements. In practice it is built on a perception where not just self-interest, but also greed, fear and suffering are driving forces behind prosperity and efficiency in the economy. Most countries give in to the quest for deregulation of financial markets, labor markets, housing markets, capital markets – in addition to the quests for welfare state retrenchments and less progressive taxes. As a result inequality sky-rocks and the developmental state withers.

Globalization may still reduce some of the gaps between developed and the developing countries. But, if China and India are left out of the equation, the gaps in well-being between richer and poorer nations – even measured inadequately by per capita gross domestic product -- have gone up, not down --- and within countries inequality has gone up nearly everywhere. In addition to the dismal trends in inequality and social injustice, global capitalism face huge problems in producing material improvements without climate change, and actually in producing some sense of belonging and happiness in the population.

One lesson from all this is that a small change can make a huge difference. It can set forth cumulative changes. A minor regulation or deregulation, for instance, can lay the economic and political foundation for new more fundamental changes in the same direction. It can go both ways. The series of deregulations that we have recently seen in many countries, may mirror the cumulative reforms and institutional change that once established the local system.

Another lesson is that we - in a longer perspective - can easily underestimate the role of markets in egalitarian reforms and the capacity of democracy to transform capitalist institutions and production relations. The most progressive and successful social reformers have built on a dual view of capitalism - both its positive and negative sides. Obviously, it is not necessarily the reforms that aim at turning the system around that make the most fundamental changes. Rather those reforms that modify or change certain aspect of the system, and keep other aspects, are, as we shall return to many times below, most likely to improve performance and enhance the well-being of the population. Thus both Smith and Marx had it right when they were heralding some aspects of capitalism and fiercely warning against others.

In any case, the real question is no longer whether capitalism can survive - and whether socialism can work. Rather we should ask what is the feasible mix of markets and regulation, of social organization and individual autonomy, of social protection and capitalist dynamics, which work best as measured by well-being and social justice

There are several ideas of how to combine markets and social empowerment to enhance well-being – how one can create a more just society by confronting greed-driven global capitalism. One can:

- take wage determination out of market competition and place it into a system of collective decision making

- expand the welfare states at the national level, especially the universal welfare programs

- provide a national basic income system that frees workers from the slavery of capitalist relationships,

- transform the structure of property relations and capitalist relations that reclaims the need for collective forms of property,

- stimulate worker cooperatives where the direct producers in each enterprise make all major decisions and share the revenues,

- work for a new global order with a supranational state that is able to tax, regulate and redistribute capital and income (which can of course include a basic global income) across national borders.

In all these alternatives there may be a strong complementarity between markets and social intervention emphasizing equality, participation and of social justice. They can also be strengthened by combining some of them.

One specific victory today can lay the foundation for the implementation of other reforms tomorrow. It is important both to use markets and to tame their forces somewhat by democratic polices and institutional change.

Before we discuss all this in more detail we briefly go through some summary measures of the recent trends in well-being and social justice in section 2. Section 3 discusses the more fundamental questions of what is the just way to allocate resources, income and wealth in society. Section 4 evaluates from a historical perspective the ability of different economic systems to bring about social justice and well-being. Section 5 draws on the previous discussion and seeks to provide policy recommendations for both developing and developed countries in their quest for social progress. Section 6 concludes seeking to highlight the key challenges to achieve social progress in the 21st century.

2. An overview of the evolution of well-being and social justice worldwide

Together with the need to redress situations of social injustice and poverty comes the necessity to obtain measures for such notions that are internationally comparable and consistent over time. Indicators of social justice and well-being have become widespread, although universal coverage is quite rare. Undoubtedly, the human development index (HDI) developed by the United Nations since 1990 represents the most ambitious attempt to provide a nearly universal measure of levels of well-being around the world. The HDI comprises three dimensions that are deemed as basic for individuals to fully develop their capabilities: their health, level of education and material standards of living. Indicators for these dimensions are taken to be life expectancy, expected years of schooling and gross national income per capita (GNI); these indicators are standardized and combined with equal weights in a geometric mean (see Technical Notes to Human Development Report, p.2).

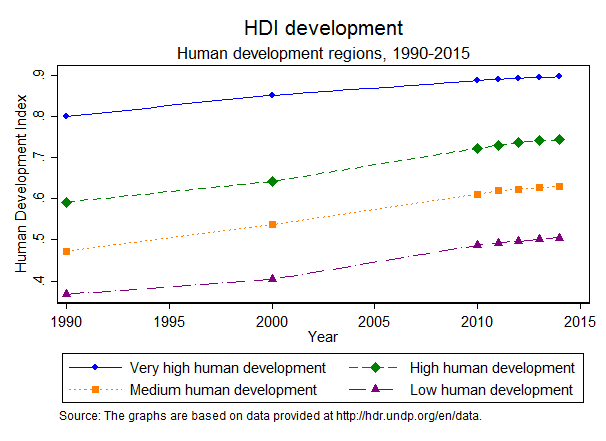

Figure 1 shows the evolution of the HDI from 1990 to 2015 for different groups of countries. Countries classified as having “Very high human development” – namely, HDI above 0.8 in 2015 – include mainly like Western European countries, the US, Canada and similarly developed countries. Countries belonging to the group of “High human development” - HDI between 0.7 and 0.8 in 2015 - are, for example, the Russian Federation, China and most countries in Latin America. India, some African countries and Central Asia have typically a ”Medium human development” - HDI of 0.55-0.7 in 2015. Finally, countries with “Low human development” – namely, HDI below 0.55 in 2015 - are mostly Sub-Saharan African countries.

Figure 1. The evolution of the Human Development Index (HDI) by group of countries (1990-2015)

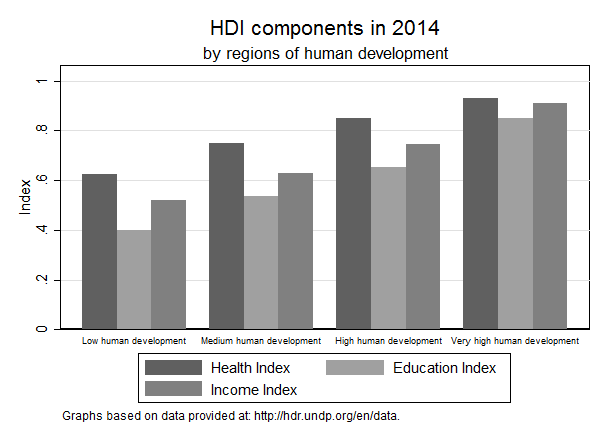

The graph tells a mixed story. On the one hand a steady trend of increasing HDI characterizes all four groups. The rate of growth of HDI seems even to accelerate, through rather modestly, after the year 2000. Nonetheless, the gap between these four groups, and in particular between the very high and low human development groups have decreased only marginally. In 1990 the gap equaled 0.433 of the index scale, whereas the gap was only 0.391 in 2015. A reduction of less than 10% of the gap after 25 years of constant global effort to reduce between-country disparities seem quite a modest improvement. Simply projecting these trends over the future reveals that full convergence between countries will only be reached in the year 2067. Figure 2 reports the HDI score in 2014 broken down by each of the three components and group of countries. Note that education is the one component where low human development countries rank the lowest.

Figure 2: Human Development Index score per group of country and sub-indicator

Although recent approaches to measuring social justice tend to emphasize the relevance of equality of opportunities (see section 3, this chapter), the levels of inequality in income and wealth are widely used indicators to measure the extent to which a society can be considered as just. The interest in inequality has led to unprecedented efforts to put together long-run datasets that are now available for a broad range of countries (Piketty, 2014). The Gini Index is a widely used measure of country-level inequality, which considers the extent to which the cumulative distribution of income in a society differs from a perfectly egalitarian distribution of income. In particular, the index can range from a value of zero, indicating that each individual in the society owns an equal share of the income, to 100, which indicates that a single individual owns all the income in a society while all others own nothing.

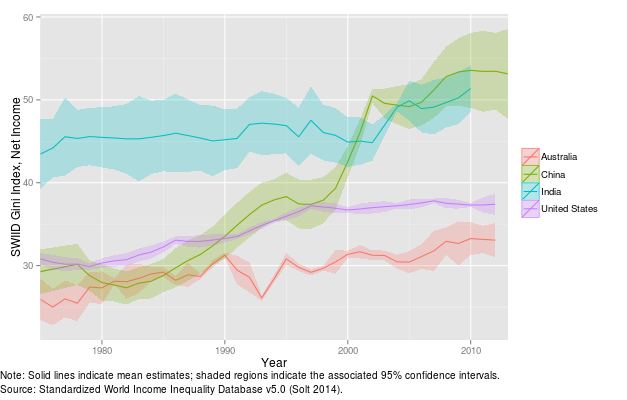

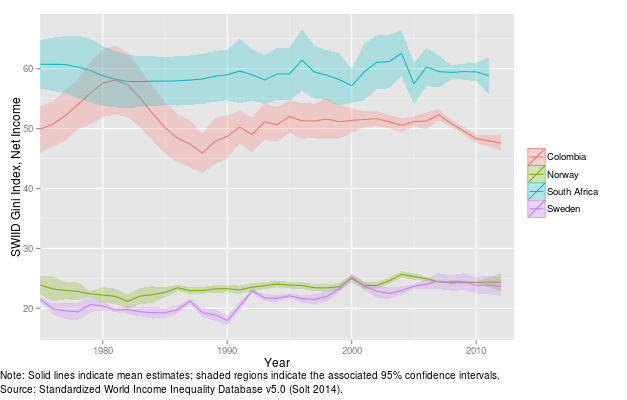

Figure 3. Evolution of the Gini Index for a selected sample of countries, 1970 - 2015

Figure 3 shows the evolution of the Gini index for a selected number of countries from 1970 to 2015, using inequality in net (post-tax, post-transfer) income. Data on the Gini index are notoriously difficult to compare internationally given the differences in the units of observations being used across countries. Here we use data from the Standardized World Income Inequality Database (SWIID), which has made a specific effort to construct an internationally-comparable dataset (Solt, 2016). Missing data for some years have been replaced by interpolations from other years. This is the reason why the graphs report confidence-interval bands to measure the precision of the estimate. These graphs show that inequality can be widely diverse between different countries. The Gini index has remained below a value of 30 over the whole period in Germany and some Scandinavian countries, but it has reached levels close to 60 in Zimbabwe and South Africa. What is more, inequality can change dramatically over time. This is apparent for China, which moved from levels of the Gini index below 30 during the 1980’s to levels above 50 after 2005. Inequality in Brazil and Colombia, two of the countries with historically highest levels of inequality, experienced a steady decrease in the last decades.

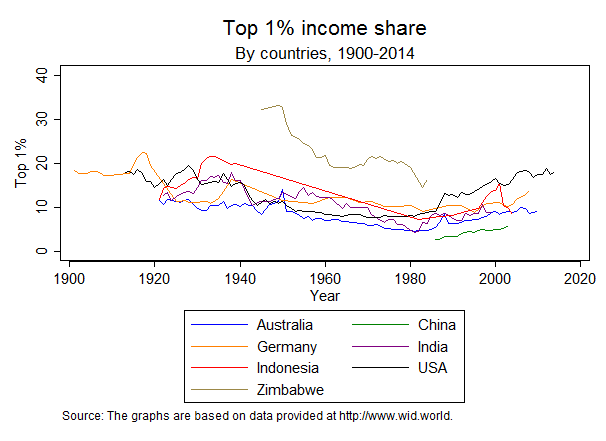

Another common approach to measuring economic cleavages is the share of income possessed by the top 1% in the income distribution. This measure only focuses on the ratio of income possessed by people at the top of the income distribution and all others. It is therefore not sensitive, unlike the Gini index, to variations in income shares for classes of income below the top 1%. It nonetheless has the merit of offering a stark comparison between income levels of the very rich people living in a society in comparison to all others. Figure 4 shows the evolution of the top 1% income share for a selected sample of countries.

Figure 4. Evolution of the top 1 % income share by countries, 1990 - 2016

While the Gini index appears to evolve in different ways in different countries, the evolution of the top 1% income share shows remarkable similarities among the countries considered. Inequality experienced a decreasing trend up from the beginning of the 20th century until the 1980s, which was then reversed. Interestingly, countries for which complete coverage is not available – namely, China and Zimbabwe - show a trend that is similar to that of other countries for the period in which data are available. Such a “great U-turn” in inequality during the 20th century also holds for the share of wealth owned by the top 1% and has been the main focus of the well-known work by Piketty (2014). It is also interesting to note that China is still the country with the lowest share of income accruing to the top 1% in comparison to other countries in this group. At the other end, Zimbabwe stands out as the country with the highest level of income for the top 1%, although data are not available after 1984.

Recently assembled datasets also make possible to evaluate the evolution of global income inequality. Such datasets are to be considered with great caution. Particularly, the lack of nationwide household before the 1970s makes the assessment of within-country inequality nothing more than guesswork. Data are instead more reliable after the late 1980s.

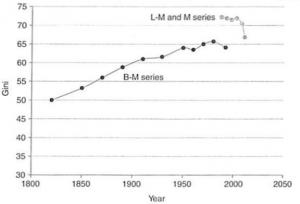

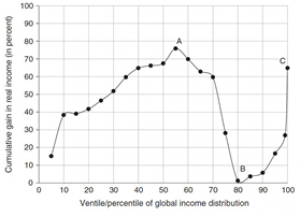

| Panel A: Evolution of the global Gini index | Panel B: Relative gain in real per capita income by global income level, 1988-2008 |

|

|

|

Figure 5: Evolution of global income inequality and recent trends in worldwide real per capita income

Source: Milanovic (2016)

Figure 5, Panel A shows the evolution of the global Gini index over a long time span. The tentative conclusion that can be reached is that only since the mid-2000s has global inequality started to decrease, mainly for the rapid development experienced by China and India. A steady rising trend characterized all previous years since 1820. Figure 5, Panel B offers an account of who have been the “winners” and “losers” of globalization. The graph plots the increase in per capita income for different percentiles of the global distribution of income over the period 1988-2008.

The graph shows that the income class that has gained the most comprises people in the middle of the global income distribution (point A in the graph). This is mainly formed by the emerging middle class in developing countries such as China in particular. According to Milanovic (2016), this rise in a “global middle class” is one of the defining features of the evolution of income distribution in recent decades. In contrast, people who appear to have gained the least are those belonging to the 80th percentile (Point B in the figure). These are mainly people occupying middle-lower classes within rich countries – in particular Western Europe and Northern America. Finally, the third defining fact of recent trends is the rise of “global plutocrats”. People occupying the top 5% of the income distribution have experienced massive gains in their incomes (Point C in the graph). These gains may be not as high as those characterizing people in 50% percentile in relative terms, but they are of course much larger if measured in absolute terms (see Milanovic, 2016, Figure 1.2). These graphs are quite telling, because changes in income relative to other income classes are often as important as the absolute income levels in determining people’s well-being (see section 2.7). The discontent of globalization losers may also be relevant to determine political outcomes.

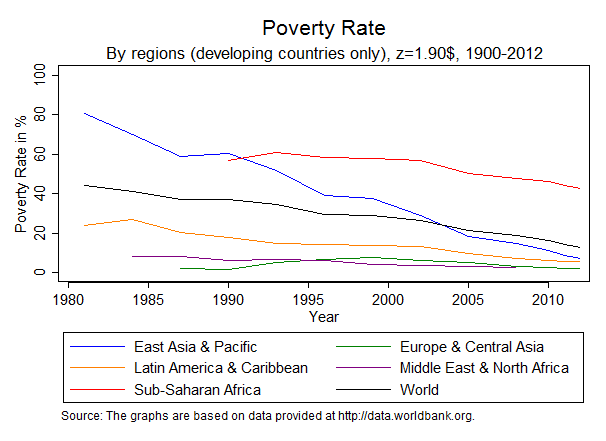

Figure 6 shows the evolution of poverty rates over time, defined by the share of citizens with income below 1.90 US Dollars (expressed in purchasing power parity). It is noticeable that poverty rates have decreased steadily from the 1980s, from levels of around 40% to around 15%. Nonetheless, Sub-Saharan Africa is the region where progress has been the most sluggish. Still 50% of the people appear to fall below the poverty line in 2014.

Figure 6: Evolution of poverty rates for the world and for regions

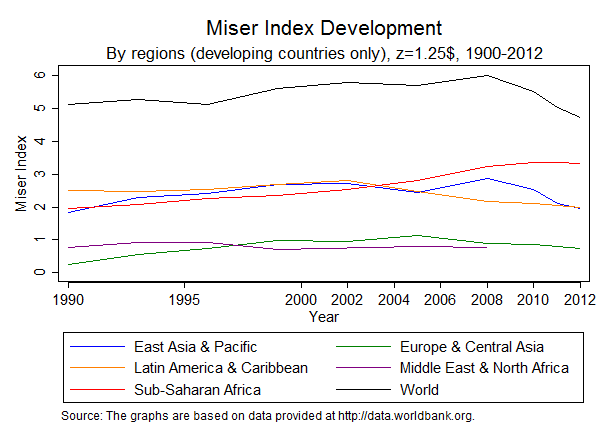

A useful measure combining information on both inequality and poverty is the Miser index, capturing to what extent poverty is unnecessary (Lind and Moene, 2011). This can be visualized as the product between the share of a country’s population that lives below the poverty line and the income difference between the average income of the non-poor and the average income of the poor. It can thus be interpreted as the total income gap by which the income of the poor falls below the average income of the non-poor (Lind and Moene, 2011). Figure 7 shows the evolution of the Miser index from 1990 to 2014, for a poverty line of 1.25$ in purchasing power parity. The different lines indicate various geographical regions. The Index is limited to developing countries that have a non-negligible share of people lying below the poverty line.

Figure 7: Evolution of the Miser Index

Figure 7 shows a steady increase of the Miser index for all regions from 1990 until 2005. Since then, the Miser index has decreased for all regions except for Sub-Saharan African countries, whose index has instead continued to grow. Interestingly, the Miser index applied to the whole set of countries has decreased in the last observed year to the lowest level since 1990.

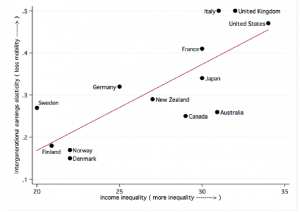

Inequality of opportunity is central in our theoretical analysis of principles of redistribution (see section 3.5). The debate over how to best measure “opportunity” is wide-ranging. Although this is only a very rough measure of opportunity, many studies use the inter-generational elasticity of income. This measures the correlation between a person’s permanent income and that of their parents. This measure has the merit of assessing how much a person’s permanent income gets transmitted across generation, thus offering an evaluation of how much a person from lower economic strata has chances to climb up the economic ladder. It is however a rather imperfect measure of opportunity both because it overlooks other non-economic aspects of opportunity, and because it looks at the final outcomes of being endowed with opportunities rather than at the initial stage of distribution of opportunities. Recently, new composite indicators of opportunities have been created, which take into account both the availability of specific services (such as education, but also electricity and water resources) to children living in a certain society (or in a specific group of that society), and the distribution of a well-being indicator (such as income, earnings, or consumption) available to individuals belonging to specific groups of the society (see Brunori et al., 2013). Figure 8 reports charts detailing the existence of a strong correlation between measures of income inequality and both the inter-generational income elasticity (Panel A) and a composite index of inequality of opportunity (Panel B). Although these charts cannot disentangle causality issues, they highlight how certain economic systems appear capable of ensuring social justice under several different domains.

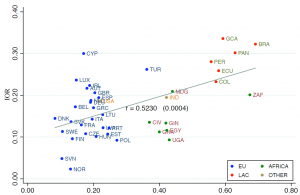

| Panel A: Relationship between income inequality and inter-generational income elasticity | Panel B: Relationship between income inequality and a composite index of inequality of opportunity |

|

|

|

Figure 8: Relationship between income inequality, inequality of opportunity and intergenerational mobility elasticity

Source: Brunori et al., (2013) for Panel A; Corak (2013) for Panel B. IOR is an index of inequality of economic opportunity, as reported in Brunori et al. (2013).

Overall, this brief account of indicators of social justice and well-being supports the view that, within a general picture of generalized progress at the global level, there still exist large gaps between the richest and the poorest countries. The gap in the HDI and in poverty rates appear to be particularly conspicuous in spite of global efforts to reduce them. Moreover, the nearly universal rise in the concentration of wealth in the top 1% of the distribution, together with the fact that the top 5% of the income distribution experienced some of the largest gains over the last two decades, make us wonder whether the general economic scenery may be less favorable to global social progress in the coming years than it has been thus far.

After this general overview of trends in social justice and well-being, our analysis now turns to a review of principles of justice and to an account of recent efforts in empirically mapping subjective well-being.

3. Visions of Social Justice and Well-Being

Any system of politico-economic institutions will result in an allocation of resources, income and wealth. We should evaluate the efficacy of these institutions by asking not only their efficiency but also how just or fair that allocation is. This topic has been the subject of political philosophy and economics for hundreds of years, but a particularly active discussion of it took place in the last third of the twentieth century, initiated by the publication of John Rawls’s A theory of justice in 1971.

3.1 Utilitarianism

Until Rawls’s work, the predominant theory of justice that had been inherited from the nineteenth century was utilitarianism associated particularly with the work of Jeremy Bentham and John Stuart Mill. Utilitarianism is the view that the just allocation can be described as the one that would maximize the sum of ‘utility’ in a population, where a person’s utility is a measure of his subjective well-being. In the simplest version, a person’s utility is an increasing and concave function of individual wealth or income: concavity means that individuals obey the law of diminishing marginal utility. If one assumes that everyone’s utility function of money is the same, then maximizing total utility requires equalizing the money wealth of everybody, and for this reason, utilitarians like J.S. Mill were to some degree egalitarians.

In the twentieth century, however, philosophers and economists came to emphasize the differences between persons’ utility functions, and hence utilitarianism no longer coincided with egalitarianism. Indeed, utilitarianism requires that resources go in greatest amounts to those who can most effectively process them into well-being.

The inference that it is better to equalize incomes (if everyone has the same utility function) assumes that the amount of income produced in a society is independent of its distribution. But this is not true: the rule for income distribution will affect how much is produced. Thus the incentive problem, that the total product will be affected by how that product is distributed, must be addressed.

Even under the simplifying assumption that there is a fixed total pie to be distributed we see that a major problem with utilitarianism is that it recommends allocating the greatest share of resources to the ‘talented,’ those who are good utility-producing machines. Its concern is only with the sum total of well-being produced, with no specific concern for the boundaries between individuals.

This view is particularly pernicious when applied to intergenerational justice. If early generations invest a large share of their resources, inducing a high rate of technological change, that will augment the utility-producing capacities of later generations. Utilitarianism in the inter-generational context recommends allocating resources over time to maximize the sum of utilities of all generations. But this might require large investment and low consumption by early generations in order to produce hugely efficient utility producers in later generations. Clearly, this cannot be just.

3.2 Rawls’s difference principle

Rawls’s task was to dethrone utilitarianism as the dominant theory of justice, and to replace it with a kind of egalitarianism. But Rawls did not recommend equality of utility or well-being: rather he advocated equalizing the bundles of ‘primary goods’ distributed to persons in a society. Primary goods are those goods that are necessary for carrying out any plan of life, so Rawls said.

But, taking into account that goods need to be produced, equalizing the bundles of primary goods might require a system of taxation that might reduce the incentives for highly skilled people to work hard. In a compromise induced by this incentive problem, Rawls modified his recommendation to distribute primary goods in that way that maximized the bundle of them received by those who received the smallest bundle. This recipe is Rawls’s ‘difference principle,’ also known as the maxi-min distribution – that allocation that maximizes the amount which the least well-off group in the population receives.

Why did Rawls not call for maximizing the minimum utility in the population? For Rawls, a person’s utility is defined by the success she achieves in realizing her plan of life – to be specific this is how Rawls defined happiness. But plans of life, for Rawls, are choices of individuals, and the state’s responsibility (or the purview of justice) is to see that people have the wherewithal to implement their plans, not to guarantee that plans are implemented with equal success. His emphasis on primary goods follows from these considerations.

3.3 Sen’s capability approach

In 1980, Amartya Sen criticized Rawls for being too concerned with the allocation of goods, instead of the concern with what goods can do for people. One might have said that goods produce utility, but Sen located a precursor to utility that he called functioning: goods allow persons to function in various ways, and functionings are the real inputs into life success. The idea is thus to evaluate a person's well-being and advantage in terms of her or his ability to do valuable acts or reach valuable states of being: to be well nourished, to read, to eat, to love and be loved, to achieve self-respect and self-esteem, to be able to reason, to have friends, and so on. The “capability set” of a person is then defined as the alternative combinations of functionings this person is able to achieve. Sen advocated equalizing the capability sets of individuals. Sen, however, never proposed how to measure when one capability is bigger or better than another: thus, he does not, strictly speaking, have a complete definition of justice.

One goal of social progress is thus to develop people's capabilities so that they can flourish and enjoy such functionings. Yet, any policy which aims at this goal must also be sensitive to whether achieved functionings are free from risk or not. It is important to people that they enjoy a certain level of functioning and that they are able to sustain it over time. It is not only the lack of functioning, but also this lack of secure functionings which make these people disadvantaged. For instance, being unemployed one lacks the functioning of work; being employed as a casual worker one lacks the secure functioning of work. In other words, not only is it important that people have the capabilities to achieve functionings, but also that they are free from the anxiety and worry associated with that such a functioning may be at risk.

Functioning in domains facing risk is associated with a ‘corrosive disadvantage', where a disadvantage in one domain is likely to spread its effects to other domains – from hunger to unbearable debt for instance. On the other hand, ‘fertile functioning’ can be said to occur when achievement in one domain carries over benefits to another domain. Friendship helps people to secure their health and also their jobs. People who have strong social ties or, in Nussbaum words, “affiliations”, were more likely to find job once they became redundant compared with people who did not have strong social ties. The most disadvantaged in society are those who experience a clustering of several disadvantages and who therefore find it most difficult to get out of poverty unless the ties between these disadvantages are broken. Progressive policies should prevent corrosive disadvantages and sustain fertile functionings.

3.4 Dworkin’s responsibility cut

In 1981, Ronald Dworkin introduced another dimension into the discussion – or rather, he amplified an issue that Rawls and Sen had treated only tangentially and imprecisely. Dworkin, as had Rawls and Sen, wanted to distinguish between the goods or resources available to persons and their choices, which would lead (in Rawlsian parlance) to a degree of success in a plan of life. Now Dworkin argued that a person should be responsible for his choices, and hence it was not the business of egalitarian justice to be concerned with life-plan or well-being equality, but rather simply with equalizing resources available to persons.

However, unlike Rawls and Sen, Dworkin defined resource bundles comprehensively – to include not only transferable resources like money and wealth, but also non-transferable ones, like the family into which a person is born, or even his genetic make-up. So equalizing resources consisted in finding the allocation of transferable resources (wealth) that would compensate persons properly for the inequalities in their bundles of non-transferable resources (family backgrounds, perhaps, being the most important of these).

How could one decide on what the ‘right’ compensation is? Here, Dworkin proposed a clever scheme, a thought-experiment. He imagined that a veil of ignorance denied persons of the knowledge of the resource bundles that they would be assigned in the ‘birth lottery,’ and that behind this veil they could purchase insurance against bad luck in that lottery. In this hypothetical insurance market, persons used their actual preferences over risk, but were endowed with an equal amount of money with which to purchase insurance. Thus, the participants in the Dworkinian insurance market were shielded from knowledge of the comprehensive bundle of resources they would receive in life, but could purchase insurance against bad luck in that hypothetical lottery.

Any insurance market implements a transfer of money from those who were lucky to those who were unlucky. (For instance, those whose houses do not burn down transfer money to those who houses do burn: this is implemented through the payment of insurance premiums by the lucky ones, and the receipt of payouts by the unlucky ones.) And so this would occur in Dworkin’s thought experiment. After the birth lottery occurs, and the ‘souls’ who participated in the insurance market become persons located in families, transfers of wealth would occur to implement the insurance contracts that had been made. Those who were lucky in the birth lottery would transfer wealth to those who were unlucky and had insured against bad luck. Dworkin defined the ensuing allocation as the one that equalized resources.

Dworkin’s scheme was ingenious, but it turned out to have a fatal flaw. John Roemer pointed out (in 1985) that unless everyone were very risk averse, the insurance market could result in the accumulation of more wealth by those who were ‘talented’ – it could result in transferring wealth from the ‘handicapped’ to the talented, or from the unlucky to the lucky. This could happen because there are two competing interests that a ‘soul’ faces in deciding on what outcomes of the birth lottery she wishes to insure against: on the one hand, she wants to avoid penury, and thus to collect payouts of insurance if she is born poor or handicapped, but on the other hand, she wishes to have enough wealth to have a really successful life if she happens to be born talented and into a family with resources. If the soul is not very risk averse, the second consideration may dominate the first one, and Dworkin’s insurance market can result in transferring resources into the pocketbooks of the talented and fortunate, rather than the other way around.

There are two ways around this somewhat paradoxical result: either to assume that everyone in society is very risk averse – or would be when making the kind of decisions required being Dworkin’s veil of ignorance – or to jettison the veil-of-ignorance approach. It is unrealistic to take the first path: there is much evidence that, although most people are risk averse, they are not so risk averse as to prevent the unpleasant outcome that Roemer pointed out from occurring. Roemer later (1993) proposed a variation on Dworkin’s proposal that deleted the veil-of-ignorance thought experiment, but preserved the distinction between one’s resources and one’s choices that Dworkin had introduced.

3.5 Equality of opportunities

In 1989, Richard Arneson and G.A. Cohen, two political philosophers, each contributed further to the debate on egalitarian justice. Arneson argued that Dworkin was correct to make a distinction between choice and resources, but said that ‘equalizing resources’ should not be the objective – rather, it should be equalizing opportunities for welfare or well-being. Preferences would enter in what path a person chose once such opportunities were equalized. Cohen argued that Dworkin had improperly placed the ‘cut’ between resources and preferences. The right cut was between aspects of a person’s situation for which he should not be held responsible and aspects for which he should be held responsible. In particular, a person should not be held responsible for choices that were induced by preferences that were induced by circumstances beyond his control. If a person grows up in a poor family and neighborhood, has bad experiences in school as a result, and develops a preference against further education, should he be held responsible for the choices that ensue regarding his education? Cohen said no, but Dworkin maintained that responsibility for choices should be maintained as long as the individual identified with his preferences.

Dworkin suggested ‘equalizing resources’ rather than well-being, because of the problem of expensive tastes. A person who has expensive tastes should not, at the bar of justice, receive extra resources to satisfy them, and this counts against a theory of equality of welfare. But consider expensive tastes that are involuntarily induced in persons. A linguistic minority in a community may want their children to learn the parents’ language in the public schools. This is an expensive taste: but should justice ignore their demand? Dworkin’s argument would say yes, but Cohen’s no, because the expensive taste in this question is not something cultivated, but unavoidable.

Based upon this discussion, Roemer proposed (in 1993) a theory of equality of opportunity, proposing a partitioning society into types. A type consists of all persons who have similar circumstances – attributes of their social, physical and genetic environments that are beyond their control. The list of circumstances could be quite comprehensive, or fairly small. Within each type, under a given economic policy, there is a distribution of income. Where on this distribution a person sits can be caused by her choices or efforts: but the distribution of income of a type summarizes what the income opportunities are for the people of that type.

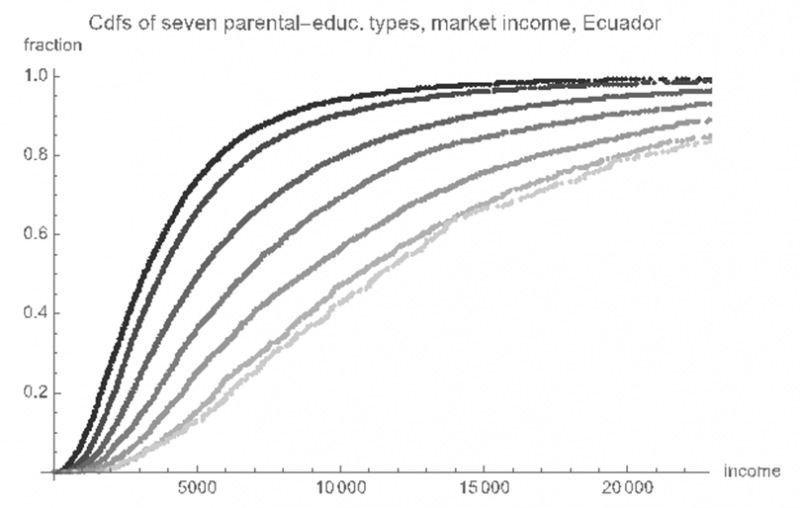

This approach is recently applied to Ecuador. In Figure 9, young male workers in Ecuador have been partitioned into seven types, defined only by the educational levels of their parents. Each curve is a cumulative distribution function of income of the set of workers whose parents have a given pair of educational levels. The curve furthest to the left is the cumulative income distribution function of male workers whose parents lack education entirely, and the curve furthest to the right is the income distribution of those workers whose parents have at least some tertiary education. Observe, for example, that the median income (0.5 quantile) of the first type is about 3000 pesos per annum, while the median income of the most advantaged type is about 12,000 pesos per annum. The stacking of these income distributions shows that, unequivocally, there is extreme inequality of opportunity for income acquisition in Ecuador, because a person’s opportunity for income is clearly closely related to his parents’ level of education. More equality of opportunity, in this case, would require that the differences between these cumulative distribution functions are reduced.

The example indicates that several choices must be made in discussing inequality of opportunity. First, what are the circumstances for which individuals should be compensated? In the Ecuador example, only one circumstance was considered – the educational level of the person’s parents. But one can expand this list considerably. That part of one’s income determined by ‘choice’ in this example emerges as the residual once circumstances are defined. So if one expands the list of circumstances to include other measures of disadvantage, the role of effort and choice will be diminished.

A society will thus determine what equality of opportunity means by the choice of circumstances it wishes persons to be compensated for. Equality of opportunity is therefore a concept that is defined as relative to the conception of circumstances and responsibility that a society wishes to adopt.

Salient questions are how much of income inequality is due to circumstances, and how much to differential choice? The answer depends upon what attributes of a person’s situation that are counted as circumstances. In the United States, for instance, a set of a broad set of circumstances (parental incomes, mother’s educational level, mother’s occupation, ethnicity, gender, rural vs. urban childhood, and height of the individual) would ‘account for’ 27 per cent of the income inequality. If in addition one includes a variety of other indicators (performance on reading and mathematics tests, a behavioral problems index, perceived quality of time spent with parents, two parents or single parent, smoking and drinking habits of parents), the resulting extended set of circumstances would account for fully 46 per cent of the income inequality. The extended list of circumstances would account 36 per cent of the income inequality in the UK.

We cannot indicate what role circumstances play in all countries because the relevant data have not yet been collected. However, for less comprehensive lists of circumstances, we can say that inequality of income opportunity is smallest in the Nordic countries and increases gradually as we move south in Europe to Italy, Spain, Greece and Portugal. In developing countries, inequality of opportunity is much greater still.

To summarize, the fertile discussion in political philosophy of the last 30 years of the twentieth century marked a move from the utilitarian view of justice to an egalitarian view. But whereas utilitarianism advocated the view of justice as the maximization of total well-being, the egalitarian view did not advocate equality of well-being but rather equality of primary goods, functionings and capabilities, resources, or opportunities, in its various versions. Thus the late-twentieth-century transformation from utilitarianism to egalitarianism was characterized by two features: first, a focus on the condition of the most disadvantaged in society, as opposed to the average member, and second, a focus on opportunities/resources available to people versus outcomes of well-being.

Needless to say, the theory of equality of opportunity has made huge progress, yet it is not a complete theory of justice. So far it does not consider political participation (democracy) and civil rights. Neither is it a complete theory of distributive justice as it does not address inequality of income as such, but only differential access to income. It is conceivable that we could have a society with virtually full equality of opportunity for income with respect to a comprehensive list of circumstances, but still considerable differences in income, and that would be undesirable, because it is probably impossible for people to treat each other as citizens with equal dignity if their material conditions are vastly different.

G.A. Cohen (2009) addressed this issue when he argued that the achievement of community among citizens requires limitations on the extent of income differences. Whether limiting income differences once equality of opportunity has been achieved should be considered an issue of justice or one of the decency of a society is an open question.

Figure 9. Cumulative distribution functions of income, male workers in Ecuador, partitioned into seven types based upon parental levels of education

3.6 An empirical review of perceptions of distributive justice

The theoretical literature we have reviewed above has also inspired empirical investigations examining which principles individuals use when making judgments on the fairness of a given earnings distribution. This strand of research comprises both “vignette studies”, where individuals are asked to rate the fairness of different hypothetical situations, and experimental studies, where individuals are asked to assess an actual allocation of earnings administered in a laboratory (or, in some cases, in real life) and propose a redistribution scheme from richer to poorer participants.

In spite of the differences that naturally arise across studies, the overwhelming consensus is that most people are indeed sensitive to individual relative responsibility in producing their earnings. First of all, full equalization of outcomes generally attracts little support when individuals are asked to evaluate earnings allocations. In the context of vignette studies (Schokkaert and Capeau, 1991; Konow, 1996), individuals would abide by an egalitarian principle only in the special case when those variables that are normally relevant for individual responsibility are perceived as having been equally applied. In survey studies, only between 3% and 7% of US respondents are in favor of complete or near equality of income (McCloskey and Zaller, 1984; Kluegel and Smith, 1986). To be sure, these studies do not address utilitarian theory as such, because the currency being redistributed is individual earnings. Nonetheless, a general lack of support for strict egalitarianism is evident.

Interestingly, very few people seem to adopt the Rawlsian difference principle either (see section 2.2). In a seminal experiment that purportedly reproduced Rawls’s original position, only one group out of 81 opted for the difference principle (Frohlich et al., 1987). Lack of compliance with Rawls’s difference principle has been confirmed in other studies using different methods (Konow, 2003; Schildberg-Hörisch, 2010). In general, most groups seem to reach consensus on a mixed rule, that is, to maximize expected income subject to a constraint on the minimum income, the so called Boulding hybrid principle (Boulding, 1962; Frohlich et al., 1987; Konow, 2003; Traub et al., 2005).

Second, and perhaps most importantly, individuals are clearly willing to reward individual effort or abilities when these are conducive to greater earnings. The amount of redistribution requested by experiment participants is considerably higher when luck, rather than individual effort, determines earnings (Durante et al., 2014), and individuals are willing to reward more those people who chose to work more (Konow, 2003; Cappelen et al., 2010). Nonetheless, Cappelen et al.’s (2007) pioneering study supported the view that people’s compliance with redistributive criteria cannot be reduced to a unique principle. Around 38% of participants can be classified, in the authors’ words, as “liberal egalitarians”. Those are people who compensate for inequalities caused by factors beyond one’s control – such as random differences in the wage rates – but do not compensate for inequalities that are caused by people’s choices – such as how much effort they put in the task. Nonetheless, a non-negligible portion of participants - about 18% – are classified as pure libertarians, as those people do not compensate for differences in luck. Perhaps surprisingly, the most numerous category in this experiment is formed by strict egalitarians, who pursue full income equalization. The contrast with the evidence reported above is likely due in part to differences in the experimental design and in part to the sample nationality. The experiment was in fact conducted in Norway, where egalitarian norms are, arguably, part of the national social ethos (see section 3.5). In a still unpublished work, Almås et al., (2016) replicate the same experiment in Norway and the US, finding a proportion of strict egalitarians in Norway more than twice as high as in the US. By contrast, libertarians are more than twice as numerous in the US as in Norway. Farina and Grimalda (2012) find comparable results.

Differences in the way people assess inequality in their societies also emerge in survey studies. Osberg and Smeeding (2006) find in general gross underestimation of the extent of income inequality in each of the country being surveyed, where perceived inequality is measured by the ratio of the estimated earnings of firm CEOs to production workers. Such underestimation is largest in the US. Most importantly, opinions differ widely across countries on the extent to which people at the top end of the income scale are entitled to earn in relation to people at the bottom. The acceptable ratio of top earnings to bottom earnings can vary from a mean value of 12.3 in Japan to one of 3.1 for Spain.

Given that many people in each country show a general tendency to hold people responsible for their choices, but not for the effects of luck, an interesting empirical question is where exactly individuals place the “responsibility cut” (see section 2.4). The evidence on this aspect is scant, but seems to favor the view that some attributes for which people should not, in principle, be held responsible, such as their natural talents in performing certain tasks are seen as valid entitlements to acquiring larger earnings (Konow, 2003). In other words, people generally seem to favor a meritocratic view whereby individuals are entitled to reap the benefits from all the attributes of their person, but not those of random events external to their person.

Few studies assess how people react to relative need. In one of these studies, Cappelen et al. (2013) find that individual needs are important factors in people’s propensity to redistribute. In particular, willingness to transfer resources by individuals living in rich countries toward individuals living in poor countries is higher than the share of income given as foreign aid. Nonetheless, factors other than needs, such as individual merit, appear to be even more relevant in explaining preferences for redistribution. Overall, their evidence suggests that perceptions of international justice might differ from perceptions of national justice. Cross-country empirical evidence is still in its infancy; therefore we need more research to check the robustness of the findings here reported.

3.7 Science and Technology Study and feminist perspectives

3.7.1 Science and Technology Study perspective on Social Justice and Well-being

A Science and Technology Studies (STS) perspective shifts focus from a normative discussion of how justice and equality ought to be conceived to the concrete practices by which they have been achieved. Attention is directed to how multiple interpretations of (in)justice and (in)equality are enacted and become embedded in more or less durable institutional structures, technologies of governance and social norms. The STS perspective attends to the diversity of existing pathways towards social progress, advocating plural, and potentially contested, understandings of ‘progress’ that are situated in context. The focus of research is on the interaction of semiotics (concepts) and materiality (things) and the diversity of actors/actants (both human and non-human) that co-construct social progress.

Social justice, from the STS perspective, can be conceptualized in terms of the processes by which ethical concerns for equity become embedded in co-evolving “configurations that work” (Rip and Kemp 1998:387) in specific contexts. These configurations, or sociotechnical assemblages, are comprised of practices, collective norms, shared expectations, theories, laws, accounting techniques, machinery, built environments, rules of ownership and access, IP, market mechanisms, financial instruments, commons management and taxation regimes. Barriers to social justice, such as inherited sociotechnical landscapes of embedded inequality, can also be analyzed from the STS perspective, thus deflecting a more essentialist focus on the anti-social pathologies associated with self-interested rational behavior, represented by some as ‘human nature’.

In a world where great inequality persists and many millions of people live in dire poverty it is tempting to focus on all the barriers to the achievement of social justice and well-being. But this will not necessarily contribute to a forward looking endeavor where we are being asked to project onto the future what social science has learnt about how society learns, adapts and transforms. The STS perspective employed here asks what can be learnt by examining the diversity of path dependent processes involved in practically enacting and achieving social justice. Section 5.4 examines national economic and social policy that has influenced path dependent processes aimed at achieving social justice in a range of states and world regions. It also examines some important mechanisms of state and community governance that have been employed in specific national and regional contexts to monitor or achieve social justice and increased well-being.

3.7.2 Feminist perspectives

A feminist perspective on paradigms of justice emerging from Western European thought distinguishes between theories that emphasize justice as freedom, justice as equality, and justice as solidarity (Ferguson, 2009). Those seeking forms of social justice, including gender justice, have participated in projects informed by all of these theories, but only some have radically transformed specific causes of injustice.

Justice as freedom is conceived within this framework as a neoliberal or libertarian form of justice in which individual and political liberties—including the right to private property—are prioritized over any collective or government control that might jeopardize these liberties. This perspective ignores the situation of certain ‘classes’ of people who through historical forms of expropriation from land and ongoing discrimination cannot freely exercise civil and political liberties, including the right to private property and the freedom to own the new wealth that their labor produces. The practice of ensuring the ideal of ‘equal freedoms’ for individuals can, thus, obscure the on-going production of social injustice for whole groups.

Justice as equality is, as the previous sections have demonstrated, the predominant formulation that has influenced policy making directed at promoting equality in its various guises. It encapsulates a social democratic vision of redistributive justice in which the government, acting for the social whole, ensures individuals the positive freedom “to have the opportunity to meet their basic material needs and the tools they need (health, employment, education, and housing) to freely choose to pursue their life goals” (Ferguson, 2009: 165). At the global level this form of justice informs development projects by which wealthier nations act on their obligations to poorer nations they have historically harmed (Pogge, 2002). The mechanism by which material equality is ensured is via redistributive payments from the social wealth/surplus harnessed by the state. However, the capacity to equalize opportunity for all by state-led distributions of social surplus is limited by the untouchable nature of privatized wealth protected by the very freedoms espoused by libertarian theories of justice.

Both these ideals of justice and their accompanying practices and policies challenge neither the capitalist economic growth paradigm, nor the operations of the state as an enabling agent of capitalist development. Indeed they work nicely to affirm the key individualizing ideologies that normalize capitalist practice and obfuscate the collective theft of wealth and its concentration in few hands, that is, the manufacture of social injustice. The extent to which these theories of justice create actually existing social justice and well-being for all classes and categories of people is thus limited, but there are nevertheless situations in which, guided by these theories, processes for creating social justice and well-being for many have worked in historically contingent and path dependent contexts (as other sections of the Chapter demonstrate).

The final form, justice as solidarity, is informed by a relationality that places the ethical principle of care for the other at the center of justice concerns. The origins of this perspective are rooted in both the socialist tenet “from each according to his/her ability, to each according to his/her needs” and the feminist politics of recognition of the rights of those oppressed by exploitation, alienation, marginalization, cultural imperialism and violence and the need for transformational solidarity (Ferguson, 2009; Young, 1990, 2000; Hooks, 1984). Justice as solidarity foregrounds practices which transform the social and economic conditions of life for those who have experienced these multiple forms of oppression through the creation of “alternative systems that subvert the logic of capitalism, racism and sexism” (Ferguson, 2009: 171). Importantly these practices enable people to develop their human capabilities and to engage in democratic participation in social decisions. The redistributive actions involved are not limited to reallocations of social wealth appropriated by the state, but include non-state led interventions that share access and right to the production of wealth and access to basic needs.

One entry point into the complexity of path dependency is to look to the ways in which theories of justice with their diverse emphases have interacted with political decision making and technologies of governing to inform social processes that have created well-being and social justice in place. In Section 5.4 some key social justice “configurations that work” in situ are analyzed from an STS and feminist perspective.

3.8 Subjective well-being and its paradoxes

In spite of the concerns exposed above on the possibility of founding a sound notion of social justice on subjective well-being (see section 2.1), the interest in measuring subjective well-being and in comparing it both within countries – for instance comparing cross-sections of people or individuals across their life cycles - and between countries has grown conspicuously in the last decades. Partly, this interest is due to the popularization of the so-called the Easterlin paradox (1974) in economics and of the theory of hedonic adaptation in psychology (Kahneman et al., 1999).

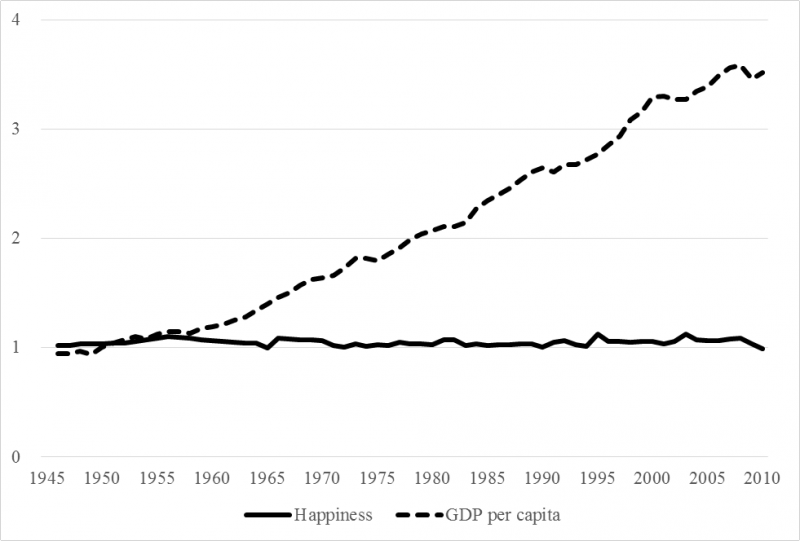

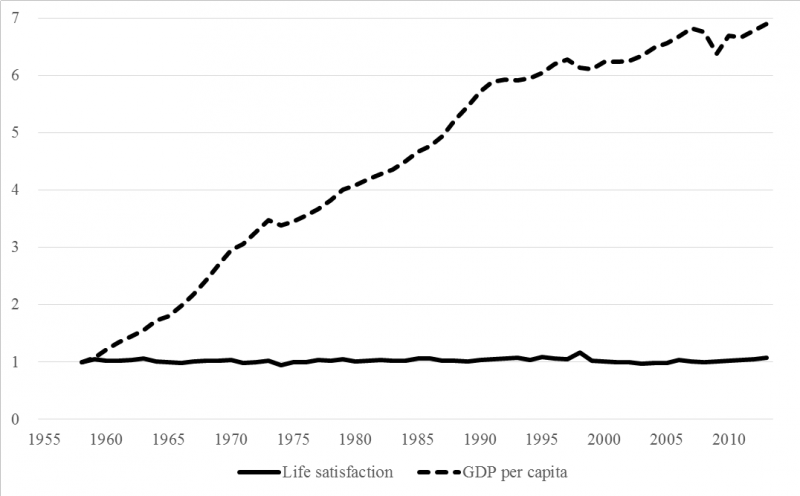

The Easterlin paradox brings out a puzzling contradiction: while satisfaction co-varies with one’s income level in each period, there is no increase in average life satisfaction over long periods of time in spite of a tripling of income levels over the period. This puzzle is based on responses to large-scale survey questions conducted in the US and elsewhere, inquiring about individuals’ satisfaction with their lives. Figures 10a and 10b illustrate the paradox in the case of the US and Japan.

Figure 10a: Income and happiness in the United States

Source: Ono and Lee 2016, forthcoming

Figure 10b: Income and life satisfaction in Japan

Source: Ono and Lee 2016, forthcoming

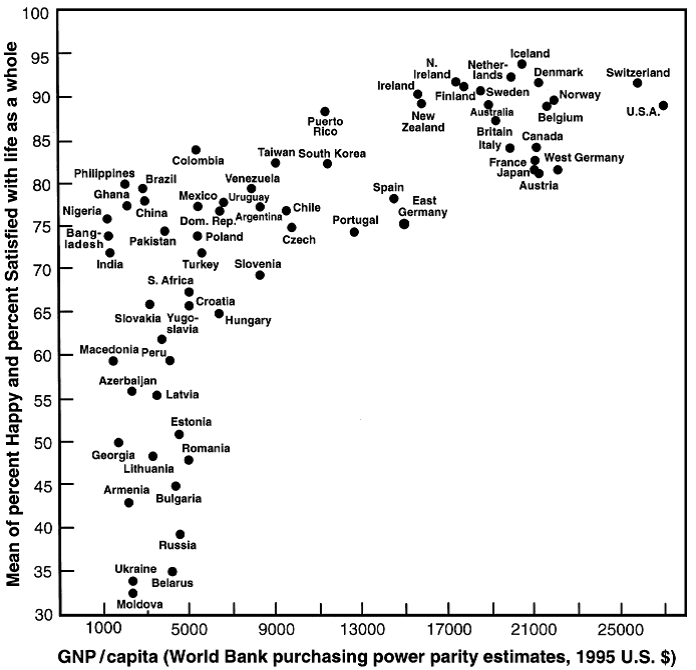

The Easterlin paradox points to a disconnect between objective well-being, as proxied by income, and subjective well-being, as measured by survey questions. The paradox has been confirmed in country-level cross-sections as well. Figure 11 shows the relationship between Gross National Product per capita and aggregate happiness from 65 countries based on the World Values Survey (Inglehart and Klingemann 2000). We observe a slightly positive association, as indicated by the moderately positive slope. More specifically, we see that the slope (which shows the improvement in happiness as a change in national income) is greater among low-income countries, and flatter among high-income countries.

In fact, if we only look at the high-income countries, clustered at the top right-end of the distribution, then the variation in happiness is small indeed. If we draw a horizontal line that cuts across countries, for example from the Philippines to Austria, we can see that happiness is indistinguishable between a low-income country such as the Philippines compared to a high-income country such as Austria. The horizontal line thus suggests that national income does not explain variations in happiness very well.

Alternatively, we can draw a vertical line around the GNP per capita $5,000, which indicates that there is huge variation in happiness within a national income level. In other words, Belarus and Brazil are nearly identical in terms of national income, but worlds apart in terms of happiness. We thus arrive at the same conclusion, that objective well-being is not a sound predictor of subjective well-being.

Figure 11: Aggregate happiness by Gross National Product (GNP) per capita

Based on the World Values Survey data.

Source: Inglehart and Klingemann 2000

One solution to the Easterlin paradox lies in the idea that a substantial portion of individual consumption is “positional” (Layard and Layard, 2011). That is, individuals derive utility not just from consuming a given good (or service) but also by consuming it while others cannot. The owner of a luxurious sport car will be normally much happier if she is the only owner of such a car in her neighborhood than when everyone owns an equally valuable sport car in her neighborhood. The reason of such a “positionality” of goods is given by the fact that people enjoy consumption, at least in part, because of the social status that is associated with such goods. Social status is by construction a scarce resource, which is eroded as more people get access to the goods conferring social status. Social status is at its highest when only one individual owns the good. Consumption by additional individuals erode the social status of individuals who already owned the good. At the limit, when everyone owns the good, no social status can be gained. Clearly not all goods have the characteristic of being positional. However, for those goods that are indeed positional, a rather perverse mechanism is set in place. That is, consumption by an additional individual creates a negative externality, that is, a loss in the utility from consuming the good, among previous consumers.

It is precisely such a negative externality that may be the root cause of the Easterlin paradox. In a cross-section of individuals, people with higher income will typically have access to a larger share of positional goods, so their subjective well-being will be higher than poorer individuals who have access to fewer or no positional good. At the same time, levels of subjective well-being over time will not necessarily grow, precisely because of the negative externality associated with positionality. Even if we consume more, our satisfaction in fact decreases as others also consume more. Many societies, and Western ones in particular, have indeed managed to achieve high levels of generalized consumption. This explains why the levels of subjective well-being cannot have grown linearly with consumption. The fact that levels of subjective well-being have in fact grown so little over time is, according to this account, testament to the idea that a very large portion of our consumption is indeed positional. The Easterlin paradox, therefore, highlights that with increasing our consumption “we run to stand still”. Consuming less than others brings about dissatisfaction, but consuming more than others will only bring about a transient increase in satisfaction.

Layard and Layard (2011) propose to treat consumption as any goods that produce a negative externality on others, like smoking, i.e. taxing it a fairly high rate. The observation of the little gains in subjective well-being derived from additional consumption also poses some difficult questions to policy-makers convinced that the main target of economic policy should be economic growth. The evidence from Figure 11 clearly shows that economic growth can be enormously beneficial in the poorest countries, but very little beneficial in the richest ones, to increase individual subjective well-being. This is of course only one component of the set of individual characteristics that policy-makers should care about when making policy decisions. However, on the basis of this and complementary evidence, it may be argued that the focus of policy-makers should switch from material development to what we may call “personal” development, as a country switches from the “low-income” region to the “high-income” region. Personal development includes aspects that have been proven to be relevant for people living in rich societies, such as social relationships with others, autonomy and freedom of expression (Inglehart and Wetzel, 2005). We believe that the studies triggered by the Easterlin Paradox have uncovered a potentially ground-breaking way of conceiving economic and social policy.

It is important to note however that there is some controversy over the Easterlin Paradox. Betsey Stevenson and Justin Wolfers (2008) used large scale data – primarily but not only from the Gallup World Poll – and show a stronger linear relationship between per capita income and average levels of national happiness. In a subsequent paper they also show a stronger relationship between economic growth and happiness than Easterlin does. While they claim to de-bunk the paradox, much of the discrepancy is in the questions that are used to measure well-being in the first instance, and in the time frame and sample of countries that are used in the second.

The question that is used to measure life satisfaction in the Gallup World Poll is the Cantril ladder question, which asks respondents to think of the best possible life they can imagine and then to place themselves on an 11 step ladder where zero is the worst possible life and 10 is the best. While most of the correlates of more open-ended life satisfaction questions and the ladder question are very similar, the coefficient on income is stronger at both the individual and country level.